Interview with Mr. Sterian, Director General and Executive Administrator of Transgaz ROMANIA – taken by Prof. Dr. Benjamin Schmitt – Atlantic CouncilUSA

Postat de Gold FM Radio pe 14 februarie 2026

- What are the remaining infrastructure bottlenecks and issues that remain to impede the successful completion of the Vertical gas Corridor?

Energy security is one of the most important dimensions of national security, as energy is the foundation of any modern state – from the economy and critical infrastructure to the population’s welfare and political stability. Energy security is an essential condition for national security, because without secure and stable energy there can be no functioning economy, resilient infrastructure, or effective defence.

The current geopolitical context marred by the profound effects of the war in Ukraine, has demonstrated more clearly than ever the importance of diversifying sources and supply routes. The recent years’ events have confirmed that energy security is a fundamental component of national security and political stability. The Vertical Gas Corridor is more than just an energy infrastructure project – it is the backbone of regional energy security.

The Vertical Corridor Concept initiative is my own and has been promoted by Romania through Transgaz since 2016 as a strategic initiative aimed at reducing total dependence on Russian natural gas and facilitating the supply of American LNG produced by American companies both in the United States and by American companies in other parts of the world: North Africa, offshore Cyprus, the Leviathan and Tamar fields etc.

This concept contributes directly to diversifying supply sources and routes, reducing dependence on Russian gas, and strengthening the energy resilience of the Republic of Moldova and Ukraine, as well as of the entire Central and Eastern Europe and the Balkans.

The members of the Vertical Corridor Initiative (DESFA and Gastrade from Greece, ICGB and Bulgartransgaz from Bulgaria, Transgaz-Romania, FGSZ-Hungary, Eustream-Slovakia, Vestmoldtransgaz-the Republic of Moldova, and Gas Transmission System Operator of Ukraine – Ukraine), recognizing the need to ensure uninterrupted natural gas supplies to their markets, as well as the importance of increasing market liquidity by facilitating alternative supply routes, joined forces to implement investments necessary to remove the existing physical bottlenecks on the Vertical Corridor route, thereby increasing the capacity of their systems, particularly in the south-north direction. The Vertical Corridor is part of the South-North Corridor within the Three Seas Initiative (I3M).

On 1 January 2025, the natural gas transit agreement between Russia and Ukraine expired, and Ukraine decided not to extend it, leading to the cessation of Russian gas deliveries to Europe via Ukraine.

This change has significant consequences on natural gas flows in Europe. For Romania, a country with considerable domestic resources and a robust transmission infrastructure, the direct impact is limited.

Romania is the least dependent on imported natural gas and plays a very important role in this respect in Central and Eastern Europe. Our country, with natural gas from the Black Sea and the Caspian Sea area, and LNG from terminals in Turkey and Greece, will become a very important hub in Central and Eastern Europe and the Balkans by 2027.

The fact that we made the necessary investments on time and that we are interconnected in reverse flow with Hungary, Bulgaria, Ukraine, and the Republic of Moldova enables us to transport natural gas from different corridors. We can import gas from Hungary, Bulgaria, the Caspian Sea, through the TANAP and TAP pipelines and subsequently through the Vertical Corridor, or even liquefied natural gas from the Greek or Turkish terminals for domestic consumption or transmission to the Central European countries.

One effect of the cessation of the Russian gas transit through Ukraine is the maximum use of the capacities at the cross-border interconnection points entering Bulgaria from Romania via IP Negru Vodă 1 Kardam, exiting Romania to the Republic of Moldova via IP Ungheni, and exiting to Ukraine via IP Isaccea 1-Orlovka. Although the physical infrastructure is being expanded, the corridor is still operating at reduced capacity.

The main bottlenecks and infrastructure problems are:

- Critical bottlenecks in Bulgaria (Rupcha-Vetrino natural gas transmission pipeline section): The most significant infrastructure bottleneck remains the 61 km section between Rupcha and Vetrino in Bulgaria. Although considered “ready for construction,” delays in building this section are limiting the reverse flow capacity needed to bring LNG from Greece to Ukraine and Central Europe;

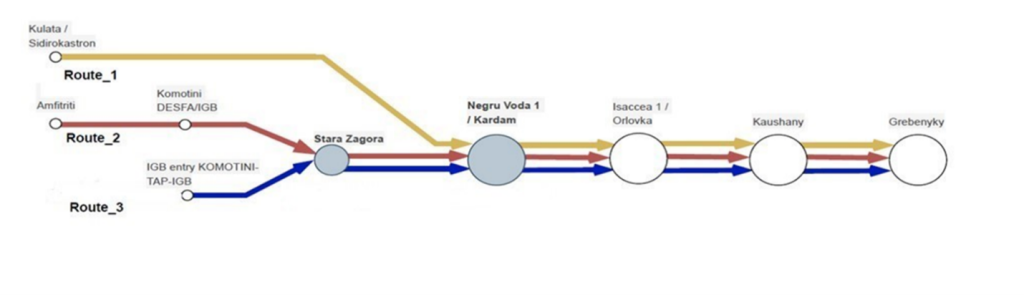

- Transmission tariffs: The higher transit tariffs on the Trans-Balkan Corridor compared to alternative transmission routes (e.g. through Poland); For route 1, route 2, and route 3 capacity products, Transgaz and Vestmoldtransgaz offered a 50% discount on the transmission tariff to render the route tariff competitive;

- Regulatory uncertainties: I am referring here to the fact that a bottleneck in the full implementation of the Vertical Corridor is also linked to the approval and extension of the capacity booking products for alternative routes (Route 2 and Route 3); The need to extend the ROUTE products (Route 1, Route 2, and Route 3) until the end of the 2025/2026 gas year, as monthly capacity products, without access to the VTPs on the route, in order to maintain the discounts offered. ROUTE products are offered additionally and are intended to ensure supply and fill storage facilities in Ukraine. ROUTE products must have specific characteristics, otherwise they are similar to standard products.

- Technical malfunctions and delays in the new infrastructure: And here I would mention, on one hand, the floating storage and regasification unit (FSRU) in Alexandroupolis, which, for technical reasons, ceased operations shortly after its launch, undermining confidence in the infrastructure’s ability to operate at stable parameters, and, on the other hand, delays at compressor stations and related infrastructure, as was the case with the Komotini compressor station (Greece), which is essential for higher gas flows and was completed with delays. These are technical and implementation issues that affect the flow on the Vertical Gas Corridor.

The Vertical Gas Corridor is an extensive pipeline system, consisting of existing and future infrastructure, including pipelines, liquefied natural gas (LNG) terminals, and storage facilities. Its full activation, through the appropriate upgrading of the networks in the mentioned countries, will enable the transmission of gas from south to north and vice versa through the European natural gas and LNG transmission systems, capitalizing on the increased capacities of the new and the developing liquefied gas terminals in the area.

By being completed and rendered operational, the Vertical Corridor will contribute significantly to ensuring and strengthening national, regional, and European energy security and will bring prestige to Romania, as well as energy security to the countries of Eastern Europe, the Republic of Moldova, and Ukraine, but also to Central Europe: Hungary, Slovakia, Poland, Austria, and the Czech Republic. The Vertical Corridor is important for the transmission of natural gas from south to north and will bring gas from the Caspian Sea area, Azerbaijan, and liquefied natural gas (LNG) from terminals in Greece and Turkey, including American LNG.

- What specific projects does Romania need to prioritize to complete to ensure that the Vertical gas Corridor can be successfully completed?

Romania through Transgaz has to prioritize the development of the Romania-Bulgaria interconnections, precisely the increase in the capacity of the interconnection points at the Southern border in order to be able to handle higher gas flows from the LNG terminals and alternative sources (Azerbaijan).

For the moment, the technical capacity at Interconnection Point Negru Voda 1-Kardam, in the direction Bulgaria → Romania is 158.87 GWh/day (25°C/0°C)), i.e. 14.5 mcm/day (15°C), (5.03 bcm/year (0)), and the capacity demand at this interconnection point is close to the level of the offered capacity which entails a major risk for congestion both contractual and physical.

The increase in the technical capacity of interconnection point Negru Voda 1-Kardam is a matter of utmost urgency in order to ensure the supply of gas, during the cold season, to the Republic of Moldova, including to Transnistria, partially to cover the needs of Hungary and Slovakia though BRUA, by the interconnection point Csanádpalota (where the capacity of 7.44 mcm/day (15), i.e. 2.72 bcm/year (15) is almost fully booked), but also to secure the capacity needs for the super-bundled products related to Route 1, Route 2 and Route 3 towards Ukraine.

Another priority is to obtain and extend the cross-border capacity products. This involves cooperating with regulators to approve the capacity products related to the Corridor so that operators and users can effectively book capacity.

At the same time, a priority for Romania is to upgrade and increase the capacity of the domestic network and to extend the gas interconnections with the neighbouring countries or to increase the capacity of the existing ones. This is why Transgaz included in the Plan for the Development of the National Transmission System (NTS) for the period 2024-2033, as approved by ANRE, projects to expand the NTS to ensure the capacity levels proposed within the incremental capacity process for the Vertical Corridor, including:

- the increase in the gas transmission capacity of the Romania-Bulgaria interconnection in the Giurgiu-Ruse direction (which envisages several development options for a capacity increase from 1.5 bcm/year to 5 bcm/year with estimated completion deadline 2027);

- the extension of the national gas transmission system part of the Vertical Corridor along the system’s Central Corridor (phased increase in the bidirectional capacity of the interconnection of Romania to Hungary from 2.72 bcm/year to 4.38 bcm/year, i.e. 5.32 bcm/year with estimated completion deadline 2028-2029);

- the interconnection Romania-Serbia (transmission capacity 1.2 bcm/year with estimated completion deadline 2028);

- development of new compressor stations and upgrading of existing compressor stations and other upgrades, pipe replacements, construction of new sections.

- What cross-border infrastructure developments need to be carried out beyond Romania’s borders in order for Romania to be better integrated into the broader concept of the Vertical Corridor, which includes both natural gas and electricity?

The Vertical Corridor is one of the most ambitious regional projects in the field of natural gas transmission. It has the potential to fundamentally reconfigure energy flows in Central and Eastern Europe, creating new transmission corridors and diversifying supply sources for the entire region.

The implementation of the Vertical Corridor will ensure an increase in transmission capacity from the current capacity of 5.03 bcm/year (0) to 9.41 bcm/year (0).

The investment required to implement the Vertical Corridor projects is EUR 1,647.81 million to ensure a capacity scenario of approximately 9.41 bcm/year (0) through IP Negru Voda-Kardam and increasing capacity on IP Csanádpalota towards Hungary in the three capacity increase scenarios, namely level 1 at 2.98 bcm/year (15), level 2 at 4.38 bcm/year (15) and level 3 at 5.32 bcm/year (15).

These investments will require US financing and European grant funding, with the possibility of taking over US LNG produced by US companies (Exxon, Chevron, etc.), including from the existing LNG terminals in Greece (Revythoussa, Alexandroupolis) and from other terminals in the design phase (eg. Dioriga, Alexandropoulis 2 Tracia, Hercules LNG, etc).

If Bulgartransgaz in Bulgaria builds the 61 km natural gas pipeline on the Rupcha-Vetrino section, it could reach up to 10 bcm/year, in this case gas from the Caspian Sea area and liquefied gas that could come from Turkey.

The coordinated development of these countries’ systems and interconnection capacities can contribute to transforming the region and the continent in terms of security of gas supply and will enable Romania to become a hub for economic development in Europe.

Given the recognition by the United States and the European Commission of the contribution of the projects to the EU’s energy policy objectives and the importance of the projects for ensuring security of supply and diversification in the region, the gas system operators in the Vertical Gas Corridor will continue to intensify their efforts to ensure adequate financing for the projects that need to be implemented for the uninterrupted and sustainable supply of energy markets of the South-East Europe and the smooth transition to a carbon-free era.

The Vertical Corridor, part of the South-North Corridor within the Three Seas Initiative (I3M), will contribute to diversifying natural gas sources and increasing the security of natural gas supplies to countries in Central and Eastern Europe and the Balkans. The integration of BRUA into the Vertical Corridor makes Romania an important player in the region’s gas market. Natural gas will be transmitted through Greece to other countries via multiple entry and exit points and from various sources of supply (Azerbaijan, Qatar, Algeria, Egypt, Iran, etc.).

As an additional measure to ensure sustainable supply to the CESEC region, during the ministerial meeting in Budapest in October 2024, all CESEC transmission system operators along the Vertical Corridor signed a Memorandum of Understanding to make joint efforts to harmonize the gas quality requirements along the entire transmission corridor.

Between March and June 2025, several technical meetings were held between gas quality and metering specialists, taking into account the requirements of standards EN 16726, EN 1776/ISO 12213, and EN 437.

As a result, the signatories of the Memorandum of Understanding reached a joint proposal for the harmonization of natural gas quality parameters, taking into account aspects related to safety, integrity, measurement accuracy, and security of supply.

The TSOs that signed the Memorandum of Understanding prepared a joint letter on the occasion of the CESEC meeting held in Bucharest in October 2025, which was sent to the national authorities responsible for regulating gas quality (NRAs or Ministries).

Current situation in Romania: The National Energy Regulatory Authority (ANRE) received the above-mentioned letter in October 2025, as well as Transgaz’ letter of November 2025, which included the draft Annex 5 – “Minimum quality requirements”, which is first submitted for public consultation, with a minimum consultation period of 30 days, followed by the approval process by ANRE.

- What regulatory or policy measures can the European Commission take to support the Vertical Gas corridor and in particular to increase the commercial viability of the corridor (in particular addressing the so called “tariff pancaking” issue as gas moves longer distances along the corridor)?

The operators (TSOs) of the national gas transmission systems of the European countries signatories to the Vertical Corridor initiative intend to apply for EU grants under the Modernisation Fund to reinforce their pipeline networks and expand interconnections between them.

SNTGN Transgaz SA has made several requests for support in financing the gas infrastructure, with the Modernization Fund currently being our main source of funding at European level.

Four projects financed under the Modernisation Fund are currently being implemented, with a grant value of over EUR 108.8 million. At the same time, five other applications with a total value of EUR 312 million were submitted for the EIB’s assessment in the first session of 2026, of which the amount requested for reimbursement is EUR 198.6 million.

Furthermore, given the strategic nature of developing the natural gas transmission infrastructure within the current geopolitical context, I believe it is necessary to undertake a joint effort to amend the legislation in order to increase the financing of these projects under the Modernisation Fund.

Thus, in order to be able to fairly and efficiently capitalize on the European financial instruments and respond to current challenges within the common energy policy, Transgaz requested the support of the European institutions, the other TSOs participating in the Vertical Corridor initiative, the Romanian MEPs, and the ministers of the relevant ministries of the countries involved in the fund’s financing mechanism, both to support the approval of the submitted projects and to facilitate legislative changes.

We believe that by acting in unity and speaking with one voice, the TSOs in the Central and South-Eastern Europe can mobilise European forums to provide increased funding for the natural gas transmission infrastructure, in order to respond to the current challenges in the field, namely reducing imports from Russia, lowering energy prices for an increased competitiveness, decarbonisation and diversification of supply sources.

According to the procedures, SNTGN Transgaz SA responds to all requests for clarification made by EIB, as a specialized technical body, in order to maximize the chances of application approval. The next session of the Investment Committee, during which the projects to be financed will be voted on, will take place in March this year, when we hear the European Commission’s position on the requested financing.

- What can Romania do to support Ukraine’s strategic role as a gas storage hub for the region and for Europe writ large? What sort of engagement can regional TSOs, including Transgaz, take to support the security of Ukraine’s gas system and commercial viability for gas storage?

Romania has a strategic role in regional energy security, being able to support Ukraine’s transformation into a gas storage hub for Europe (with a capacity of over 30 billion cubic meters) through interconnection, technical expertise, and transit facilitation.

Transgaz, together with the regional operators, is actively working to integrate Ukraine into the common European market by:

- Creating super-bundled capacity products: (Routes 1-3) to facilitate the transmission of natural gas from LNG terminals in Greece to storage facilities in Ukraine;

- Reducing transit tariffs: Transgaz has reduced tariffs on gas transit to Ukraine by half to make the supply of American LNG commercially viable;

- Romania can collaborate with the EU, NATO, and European agencies to develop strategies to protect Ukraine’s critical natural gas transmission infrastructure.

Other information

SNTGN TRANSGAZ is the technical operator of the National Gas Transmission System and ensures the performance in terms of efficiency, transparency, safety, non-discriminatory access and competitiveness of the object of activity established for domestic and international natural gas transmission, natural gas dispatching, and research and design in the field specific to its activity, in compliance with the national and European legislation and standards of quality, performance, environment and sustainable development.

Today, TRANSGAZ is a group consisting of five companies: SNTGN Transgaz SA, Transport România Hidrogen SRL, and Petrostar SA in Romania, and Eurotransgaz SRL and Vestmoldtransgaz SRL in the Republic of Moldova. It is the only natural gas transmission system operator that fully operates over 16,350 km of network across two different countries: Romania, an EU Member State – over 14,680 km (14,026 km existing, 354 km at acceptance stage and over 300 km under construction), and the Republic of Moldova, a non-EU Member State (in the process of accession) – 1,670 km.

SNTGN TRANSGAZ SA is currently the fourth company in the ranking of natural gas Transmission System Operators (TSO) of the European Union, based on the length of the managed transmission network, a group of companies focused on sustainable performance and responsibility for the future, where the corporate governance model has brought and continues to bring added value and the transparency necessary to increase stakeholder confidence in the company’s management and performance.

Since 2008, TRANSGAZ has been an active presence on the Romanian capital market, being listed on Bucharest Stock Exchange in the Premium category. 58.5097% of the shares are held by the Romanian State through the General Secretariat of the Government (GSG), and 41.4903% by other shareholders (free float), legal entities and individuals. Since its listing, the company’s market capitalization has increased more than tenfold, from Lei 1.44 billion (366 million euro) to approximately Lei 14.81 billion (approximately EUR 2.91 billion).

The positive evolution of the TGN share and market capitalization since listing reflects both investor confidence in the company’s prospects and the favourable impact of strategic decisions, financial results, and the legislative and economic context. Transgaz has thus consolidated its position on the Romanian capital market, demonstrating resilience and growth capacity in a context marked by political and economic challenges.

Regarding Transgaz’ rating, in June 2025, Fitch Ratings revised SNTGN Transgaz SA’s outlook from Stable to Positive, with the company’s rating at BBB- with a positive Outlook.

Transgaz is managed under a unitary system, with the company’s management selected and appointed in accordance with the provisions of Government Emergency Ordinance No. 109/2011 on the corporate governance of public enterprises, as amended. Transgaz correctly and transparently applies best practices in terms of the administration of publicly traded companies regarding corporate governance and professional management, the company’s managerial performance being analysed and evaluated annually in terms of the fulfilment of key financial and non-financial performance indicators approved by the Ordinary General Meeting of the Shareholders and included in the mandate contracts.